|

Posted: 12 Aug 2016 10:08 AM PDT

The back-and-forth between Facebook and ad-blocking software companies has become almost farcical at this point: After Facebook said it would block the use of ad blockers, the leading ad-blocking company announced that it will block the use of Facebook’s ad-blocker blocker. And now Facebook says it is rolling out a fix that will disable the ad-blocker’s blocker blocking. As humorous as this cat-and-mouse battle may seem, there is a serious principle at stake for Facebook. If it can’t reliably ensure that users are seeing its advertising, then the $1 billion it currently makes on desktop ads is potentially in jeopardy, and questions might also be raised about its ability to display ads on mobile too, which is a $5-billion business. That’s why the giant social network rolled out its ad-blocker force field earlier this week, with a blog post that spent a lot of time on the controls that Facebook gives to users that allows them to choose which ads they want to see, and very little time on the technicalities of blocking ad-blockers. Within a matter of hours, Eyeo—which makes the most popular ad-blocking software, Adblock Plus—wrote on its website that it had implemented a workaround for Facebook’s force field, and all users had to do was update their software with the new code. In the company’s blog post, Eyeo staffer Ben Williams said that while Facebook had taken the “the dark path” of forcing ad-blocking users to see ads, “we promised that the open source community would have a solution very soon, and, frankly, they’ve beaten even our own expectations. A new filter was added to the main EasyList about 15 minutes ago. You’ll just need to update your filter lists.” Even as the company was bragging about its ability to foil Facebook’s plans, however, the social network was busy with a workaround of its own—as Andrew Bosworth, the VP of product and business for Facebook, noted in a post on Twitter. Bosworth also pointed out that the Adblock Plus software was now not just blocking ads but also removing posts from friends and family of users as well (Naturally, Adblock Plus has since said that it has a workaround for the workaround). The fact that Adblock Plus was removing posts as well as ads reinforces why this particular war is likely to be won ultimately by Facebook. It’s not just because the social network is a $350-billion company with vast resources and thousands of developers—although that undoubtedly helps. It’s because Facebook controls everything about the experience on its platform, from the servers to the content, unlike many other sites. One thing that makes ads relatively easy to block on many websites is that most of the advertising is delivered separately from the rest of the content on the site. In many cases, it comes from ad networks and other third-party providers, who supply the code that displays the ads. That kind of code is fairly easy for ad-blocking software companies to track and identify. But Facebook controls everything about the content on its site, and so it has the ability to make the advertising look exactly like the HTML that displays everything else, whether it’s posts or photos or comments. The result is that blocking companies like Adblock Plus have to somehow determine what is an ad and what isn’t, without any of the usual code or signifiers that allow them to recognize traditional ads. And that means they have to do advanced text recognition, which is not easy. It’s not impossible, but it’s a lot harder than looking for a snippet of code that effectively says “this is an ad.” Could ad-blocking companies like Eyeo come up with more sophisticated ways to block ads that actually recognize text and the content of photos, etc.? Sure they could. But it’s going to take a large investment of time and money, and it’s not clear there’s enough incentive for them to do that. They get paid by companies like Google to “white-list” their ads, but they don’t get paid that much. And while Eyeo and other companies have to get users to update their lists and/or download new software every time there is a fix for a Facebook workaround, it’s fairly trivial for Facebook to roll out new changes without users even noticing. So whatever you think of ad blocking as an ethical choice, it seems likely that Facebook will always have the upper hand in this war. This article originally appeared on Fortune.com |

Saturday, August 13, 2016

Why Facebook Will Win the Ad-Blocking War - Fortune

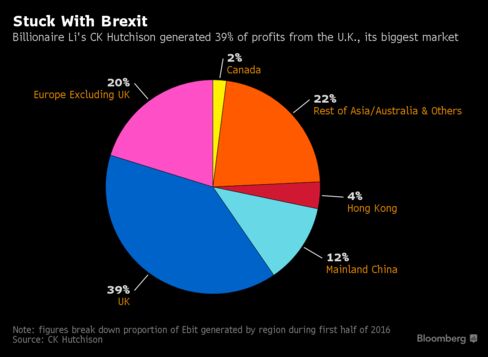

Li Ka Shing ( Hong Kong's richest man ) predicts Brexit pain will last for few years - Bloomberg

Hong Kong’s richest man, one of the biggest investors in the U.K., hit a setback in his efforts to cut his reliance on Britain and warned the fallout from the nation’s decision to leave the European Union will last for years.

"The withdrawal of the U.K. from the European Union will bring with it considerable challenge both for the U.K. and for Europe for at least the next two to three years," CK Hutchison Holdings Ltd. Chairman Li Ka-shing said in an earnings statement on Thursday, his first public remarks on Brexit since the June 23 referendum.

Billionaire Li Ka-shing.

Photographer: Calvin Sit/Bloomberg

Li has much riding on Britain as the country is the biggest profit generator at the billionaire’s business empire. His comments came hours after the Australian government signaled it would block a bid by one of his units for a local electricity distributor, a deal that could have helped the 88-year-old tycoon diversify away from the U.K.

"After Brexit, investors are keen on knowing what the impact to Li Ka-shing’s companies will be, as there are uncertainties on the U.K.’s economy and currency," said Alex Au, managing director at Alphalex Capital Management in Hong Kong.

The U.K. accounted for 39 percent of CK Hutchison’s earnings before interest and taxes and 21 percent of revenue during the first half of the year. Still, Ebit at those businesses -- which include ports, retail, infrastructure and telecommunications -- rose 4 percent from a year earlier to HK$11.5 billion ($1.5 billion).

"We are just a couple of months after Brexit. So far the numbers are pretty good, so we’re cautiously optimistic," Li’s heir and eldest son, Victor, told analysts in an earnings briefing. "On our existing business, we’ll continue to look at new opportunities. I don’t think we’ll put the U.K. off of our list."

The Bank of England earlier this month cut the nation’s benchmark interest rate and expanded a stimulus plan as it prepares for a downturn. The central bank also cut its economic growth forecast for next year and 2018, citing concerns about weaker investment and consumption.

Beyond Britain, the billionaire chairman also warned that macroeconomic and geopolitical uncertainties may hinder a global economic recovery and that market volatility will probably drag on through the second half of the year.

In China, the economy is going through "inevitable short-term fluctuations" and Hong Kong will be affected by global uncertainties, Li wrote in a separate earnings statement at his real estate unit, Cheung Kong Property Holdings Ltd., which also reported on Thursday.

Still, CK Hutchison and CK Property reported higher earnings in the first half of the year, thanks to growth from the European telecommunications business and Chinese property sales. In light of the challenges ahead, Li wrote that both companies will exercise more discipline.

CK Hutchison shares rose as much 1.7 percent to HK$94.85 in Hong Kong trading on Friday, while CK Property fell as much as 4.2 percent.

Sign up to receive the Brexit Bulletin, a daily briefing on the biggest news related to Britain's departure from the EU.

CKI is continuing to hold talks with the government, Victor Li said.

Subscribe to:

Comments (Atom)