Hong Kong’s richest man, one of the biggest investors in the U.K., hit a setback in his efforts to cut his reliance on Britain and warned the fallout from the nation’s decision to leave the European Union will last for years.

"The withdrawal of the U.K. from the European Union will bring with it considerable challenge both for the U.K. and for Europe for at least the next two to three years," CK Hutchison Holdings Ltd. Chairman Li Ka-shing said in an earnings statement on Thursday, his first public remarks on Brexit since the June 23 referendum.

Billionaire Li Ka-shing.

Photographer: Calvin Sit/Bloomberg

Li has much riding on Britain as the country is the biggest profit generator at the billionaire’s business empire. His comments came hours after the Australian government signaled it would block a bid by one of his units for a local electricity distributor, a deal that could have helped the 88-year-old tycoon diversify away from the U.K.

"After Brexit, investors are keen on knowing what the impact to Li Ka-shing’s companies will be, as there are uncertainties on the U.K.’s economy and currency," said Alex Au, managing director at Alphalex Capital Management in Hong Kong.

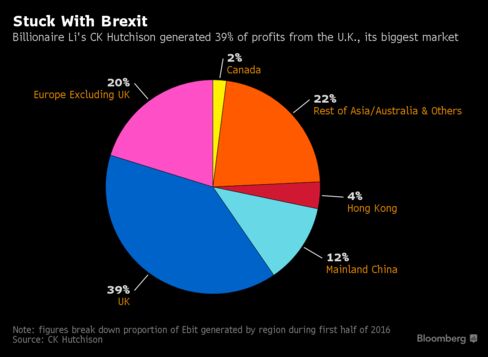

The U.K. accounted for 39 percent of CK Hutchison’s earnings before interest and taxes and 21 percent of revenue during the first half of the year. Still, Ebit at those businesses -- which include ports, retail, infrastructure and telecommunications -- rose 4 percent from a year earlier to HK$11.5 billion ($1.5 billion).

"We are just a couple of months after Brexit. So far the numbers are pretty good, so we’re cautiously optimistic," Li’s heir and eldest son, Victor, told analysts in an earnings briefing. "On our existing business, we’ll continue to look at new opportunities. I don’t think we’ll put the U.K. off of our list."

The Bank of England earlier this month cut the nation’s benchmark interest rate and expanded a stimulus plan as it prepares for a downturn. The central bank also cut its economic growth forecast for next year and 2018, citing concerns about weaker investment and consumption.

Beyond Britain, the billionaire chairman also warned that macroeconomic and geopolitical uncertainties may hinder a global economic recovery and that market volatility will probably drag on through the second half of the year.

In China, the economy is going through "inevitable short-term fluctuations" and Hong Kong will be affected by global uncertainties, Li wrote in a separate earnings statement at his real estate unit, Cheung Kong Property Holdings Ltd., which also reported on Thursday.

Still, CK Hutchison and CK Property reported higher earnings in the first half of the year, thanks to growth from the European telecommunications business and Chinese property sales. In light of the challenges ahead, Li wrote that both companies will exercise more discipline.

CK Hutchison shares rose as much 1.7 percent to HK$94.85 in Hong Kong trading on Friday, while CK Property fell as much as 4.2 percent.

Sign up to receive the Brexit Bulletin, a daily briefing on the biggest news related to Britain's departure from the EU.

CKI is continuing to hold talks with the government, Victor Li said.

No comments:

Post a Comment